Loan covenants

What happens after covenant violation?

- withdrawal of line of credit

- require immediate repayment of principal

- require more collateral

- bankruptcy

- threat of the above

Suggested reading: An Overview of Covenants in Large Bank Loans by John K. Paglia (2002).

Sister article here.

Other links:

-

Syndicate Size and the Choice of Covenants in Debt Contracts

-

Role, Structure, and Determinants of Debt Covenants: Evidence from Japan

-

Financial Shocks and Corporate Investment Activity: The Role of Financial Covenants

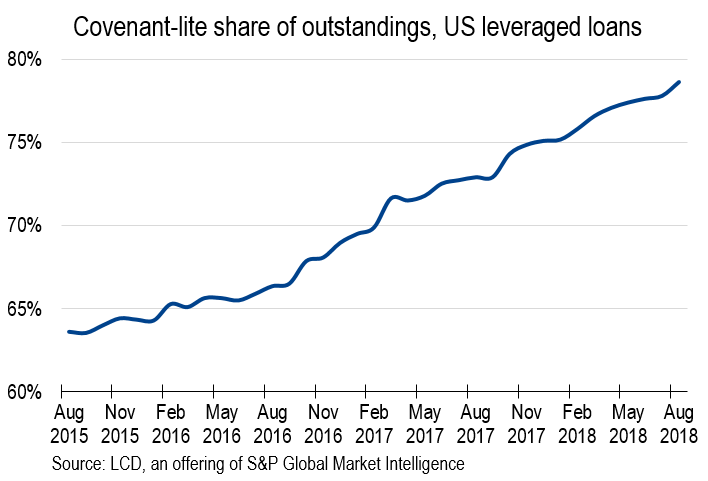

For discussion: why do low covenant (cov-lite) loans emerge?

For discussion: why EBITDA definition matters in a loan agreement?

EBITDA addbacks. Borrowers and sponsors continue to obtain friendly EBITDA adjustments. Since most covenant compliance, grower baskets, and potentially pricing are determined by reference to EBITDA, this issue has become heavily negotiated. Current borrower-friendly trends to EBITDA adjustments include:

- permitting projected cost-savings not connected to acquisitions or reorganizations,

- increased or removal of caps on pro forma cost-savings synergies,

- longer look-forward periods,

- board expenses, severance and relocation costs,

- synergies “of a type” shown in a sponsor’s QOE report,

- accrued dividends on preferred stock,

- expenses due to exercise of employee options,

- indemnification payments that are reimbursable by third parties, and others.

Contractual Complexity in Debt Agreements: The Case of EBITDA

We use the two most common financial covenants that appear in the Dealscan database, maximum debt-to EBITDA ratio and the minimum interest coverage ratio (EBITDA/interest expense), as well as two other covenants that feature EBITDA (minimum debt service coverage and minimum EBITDA).

More precisely, for each of the following seven adjustments to EBITDA, we coded (0 or 1) whether it was included in the definition:

- Non-cash charges

- Cash charges for extraordinary or non-recurring items

- Cash charges for restructuring

- Projected cost savings from synergies, restructurings, etc.

- Management/advisory fees payable to sponsor

- Fees and expenses related to acquisitions, investments, equity or debt issuances, etc.

- Miscellaneous additional addbacks

Conclusions

Becker and Ivashina (2016) show that 70 percent of leveraged loans issued in 2015 lacked traditional financial covenants and argue that the rise of these covenant light, or “cov-lite”,loans is driven by the influx of non-traditional lenders with high renegotiation costs, such as CLOs and mutual funds. Policymakers and the business press alike have highlighted the potential danger of such loans. Indeed, the Federal Reserve issued supervisory guidance in March 2013 on highly-leveraged loans and Bloomberg recently speculated that weak protections in these loans might lead to the next crisis.

source: Losing Control?The 20-Year Decline in Loan Covenant Restrictions

This is happening here