Flow of funds (FoF)

Introductory notes:

- part of or extenstion of system of national accounts (link to SNA refresher):

gross savings = fixed cap investment + net lending + stat discrepancy - balance sheet (stock) and transaction (flows) tables

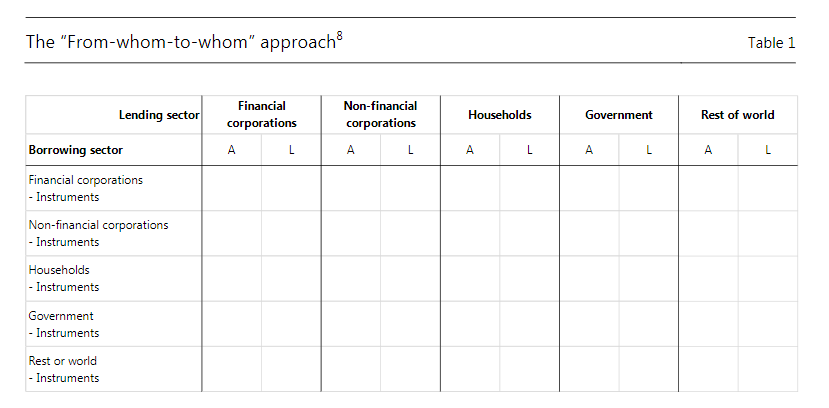

- sectors x instruments table ('2d'), sectors x instruments x sectors table ('3d')

- valuation at market prices (different view on book value in corporate reports)

closing stock = opening stock + flow + revaluation + other changes (eg. writeoff)

Expected takeaways:

- bank-based (loan) vs market-based (bonds) financial system

- size of corporate debt (loans and bonds)

- more debt instruments (several types of loans, trade credit)

- cautious about:

- equity shows at market, not book value

- aggregation vs consolidation of exposures

- nonfinancial sector net position (net worth)

- discussion on what is missing in FoF statistics and where to find it

Suggested reading (methodology): Development of financial sectoral accounts. New opportunities and challenges for supporting financial stability analysis by Bruno Tissot November 2016. BIS/IFC

Excercise

Excel file (links inside):

- US

- Euro area

- Japan

- Russia

Interactive example: UK

Sector-to-sector instrument matrix ('3d'), link

To discuss: how does chart below prove UK is an international finance center?